Our Structure

- Width: wide

- Align: left

- Color: white

- Image:

How We Invest

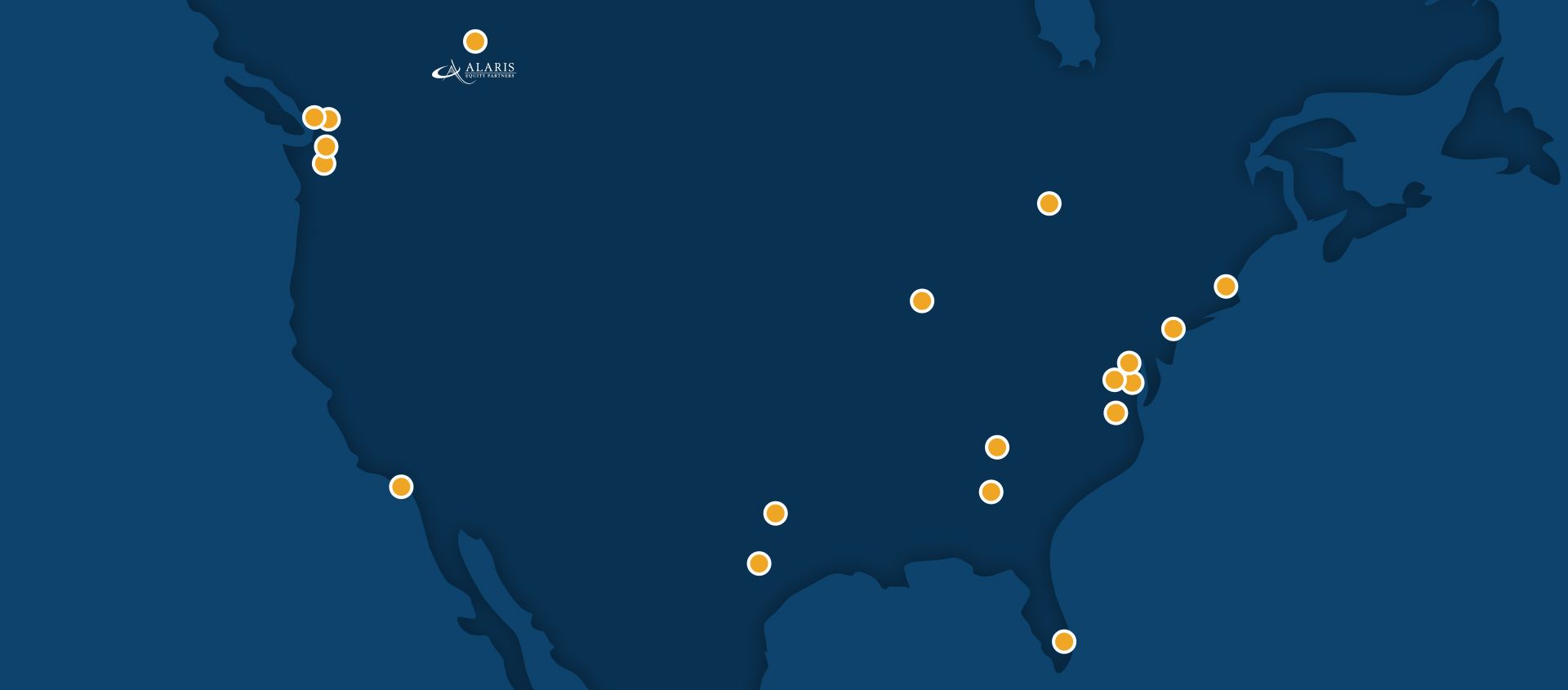

Alaris recapitalizes up to 85% of the equity in lower middle market companies in North America through non-control, preferred equity investments.

-

Historical free cash flow in excess of $7,000,000

-

Proven management teams who wish to maintain operational control of their business

-

Market leaders in the industries they serve

-

Asset-light and low risk of obsolescence

- Width: wide

- Align: center

- Color: blue

- Image: /upload/section_settings/2/43db930cdeec/190714225143-handshake-blue.jpg

Transaction Size

Initial investments of $30 million of Alaris Capital

- Width: wide

- Align: left

- Color: gray

- Image:

Capital Uses

We invest in private businesses in Canada and the United States through a combination of a non-control preferred equity and common equity.

Business Owners have used Alaris to buyout their exiting shareholders and in the process, consolidate control of the common equity in their business where they have the ability to control the operations, strategic vision, culture and time horizon all while benefiting from the majority of the upside in the growth that they deliver.

Business Owners who are looking to eliminate refinancing risk, have access to follow-on capital from a true long term equity partner and want to benefit from the majority of the upside from the growth that they deliver, have used Alaris to recapitalize their balance sheet.

Business Owners who have ambitions to build their business with a long term mindset have used Alaris to help fund their continuing growth. Alaris provides continuous access to equity capital and a partner that allows the business owner to control the time horizon. This encourages Business Owners to make long term decisions while providing them with more of the upside than they would achieve under a traditional PE relationship.

Business Owners who want to experience a liquidity event today, but are adamant about keeping the business in the family and maintaining the culture they have successfully built, have used Alaris to accomplish these goals.

Business Owners seeking to monetize a significant portion of the equity built up in their business today but also want to remain in control of their business, continue to dictate time horizon, while being the largest participant in the future growth of their business have used Alaris to facilitate these ambitions.

From signed Letter of Intent to completion of due diligence and closing, expected to be 45-60 days

- Width: wide

- Align: left

- Color: white

- Image:

Preferred Equity

Alaris invests by way of a preferred share and common equity as opposed to the traditional buyout private equity model. These preferred shares have several attributes that give both economic and “soft issue” benefits to our private company partners:

1. Non-Voting

Entrepreneurs can keep voting control of their companies because Alaris uses non-voting shares. We do not require board representation and do not impose on the operational decisions in a company.

2. No “Put” Option

Alaris is one of the only private equity investors in the world that does not include a put right. The decision to sell the business in the future is solely the entrepreneur’s, thus eliminating refinancing risk that exists with both debt and equity alternatives.

3. Limit on Growth Participation

Because we do not rely solely on an exit to generate our returns, the preferred shares are entitled to a regular dividend, just as the entrepreneur’s common shares are. The only difference is that the preferred shares have a different dividend policy. The preferred shares go up and down with the top line results instead of net income so that we don’t have to be involved in the day to day decisions.

- Width: wide

- Align: left

- Color: gray

- Image:

How is Non-Control Equity Possible?

Non-control equity is possible when:

1. An equity partner does not rely solely on a future exit to generate their returns

- Alaris works with business owners to achieve their goals and set their own timelines

- Alaris generates returns monthly through distribution payments

- The common equity holders have a call option after three years, which allows common equity holders to sell the business or repurchase Alaris' units

- No requirement of board representation or management participation, but will participate upon request

2. The returns are not directly tied to the company’s bottom line results

- Alaris' distributions are dependent on the growth in a top line metric vs the prior fiscal year

- Width: wide

- Align: left

- Color: white

- Image:

Distributions

Alaris provides cash financing to Partners in exchange for a predetermined distribution, as follows:

- Received monthly and determined 12 months in advance

- Annually adjusted based on the percentage change in a top-line, audited performance metric such as gross revenues or same store sales for example

- The Annual Change in Alaris’ distribution is restricted by a collar that allows entrepreneurs to retain the majority of future growth

- This “collar” allows the common equity holders to receive a disproportionate amount of the growth and value they create above the ceiling on the collar

- Paid before applicable taxes to provide structural efficiency

- Under an LLC structure, the company’s taxable income is reduced

- Alaris will receive its distribution of which Alaris will be responsible for paying taxes thereon

- The Partnership's common equity holders will receive the remaining income allocations and will be responsible for paying taxes on this portion only