Our Difference

- Width: medium

- Align: center

- Color: blue

- Image: /upload/section_settings/4/448e42c8dd77/charts.png

Alaris allows private business owners to:

. Dictate the time horizon

. Control the business' culture, strategic vision and operations

. Significantly benefit from the value they create

- Width: wide

- Align: left

- Color: white

- Image:

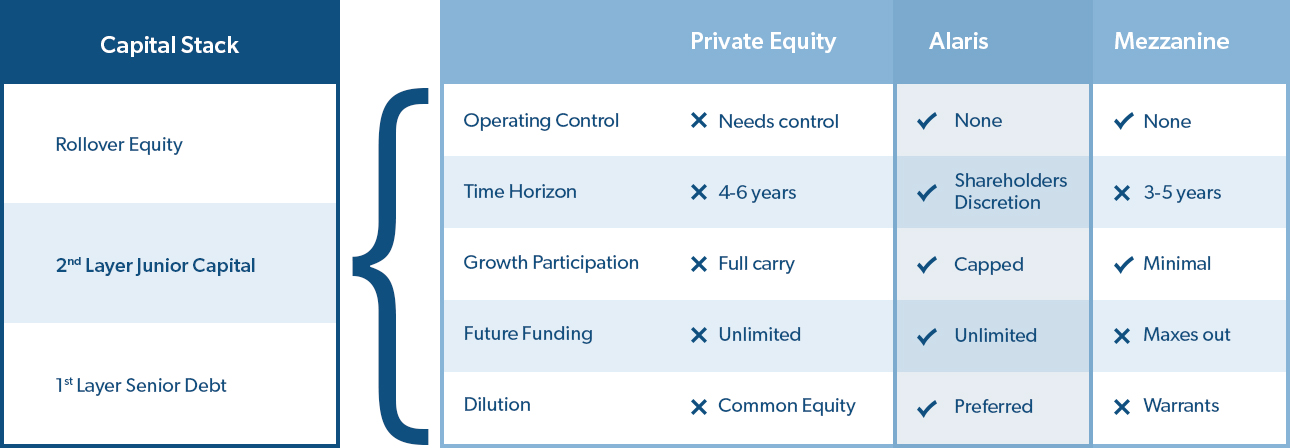

Alaris vs. Junior Capital Providers

Alaris’ preferred equity competes in the Junior Capital space with Mezzanine Debt and Traditional Private Equity.

Alaris vs. Debt

WHY NOT USE DEBT?

Debt payments are fixed and are not sensitive to the potential economic fluctuations of a business.

Alaris’ distribution fluctuates up or down annually based on the results of your business. Our distribution is set for a year in advance and changes based on a mutually agreed upon performance metric; which is a “top line” audited financial measure such as same store sales, gross revenue, or gross profit. We call ourselves a “partner” for a reason. We correlate our distribution with the economics of your business to minimize risk, to the benefit of you and your business.

Debt often includes restrictive covenants that can influence a company’s ability to grow, place restrictions on the use of proceeds, as well as limit the amount of proceeds available to a company.

Alaris is a long-term partner. We utilize consent rights and protective covenants to protect our interest but not to limit our Private Company Partners’ growth. We are motivated to grow with you and your business. Alaris has now closed over 40 “follow-on” contributions with our Private Company Partners in order to fund growth and to provide liquidity.

- Width: wide

- Align: left

- Color: gray

- Image:

Alaris vs. Equity

WHY NOT USE TRADITIONAL PRIVATE EQUITY?

Traditional private equity generates returns by selling the acquired interest in a company at a future date. This is often accomplished through the outright sale of the business.

If you own a business that is not “for sale”, chances are that maintaining control of your business is non-negotiable. For this reason alone, traditional private equity can be a challenging option. With Alaris, a future sale of the company will be solely driven by your goals. We are a unique financing option; in that we are not required to return capital to our equity holders at any point. The objective of this differentiator is to facilitate better strategic decisions and support your long-term view of the business.

It can be quite costly to give up a meaningful equity stake in your company and share your business success with a third party.

Alaris limits participation in your company’s success and growth. Growth from acquisitions and new locations remains entirely with you. Our equity dividend distributions can be capped in order to protect you from potential or unexpected business fluctuations and also to limit our participation in your company’s growth. The result - remarkable economics for you and your business that traditional equity providers have an extremely difficult time matching.

- Width: wide

- Align: left

- Color: white

- Image: